Islamic Loan Vs Conventional Loan

It has bank depositors and customers on the basis of loans given to. It has deposits as its inputs and loans made to customers as outputs.

Is Islamic Finance Better Than A Conventional Mortgage

The prescribed rate is based on a margin above the banks base lending.

. An Islamic loan is based on Shariah Laws the Islamic religious law as stated in the Quran Hadith and Sunnah. Video original recorded for Huda TV in the aftermath of the Global Financial. Conventional Bank as Loan House.

Top 10 Mortgage Lenders To Finance Your New Home. Call Unity Bank For Details Today. Choose The Loan That Suits You.

Finance Through A Licensed Service Provider. See if you prequalify for personal loan rates with multiple lenders. Save Time Money.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Financing For Your Equipment Business Acquisitions Other Fixed Assets. Difference between Islamic financing vs conventional loan You can find our articles in these post.

Trusted by Over 1000000 Customers. An Islamic mortgage differs from a. Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best.

It is a loan house. Over the years however the idea that halal loans may cost more than conventional. Expert Reviews Analysis.

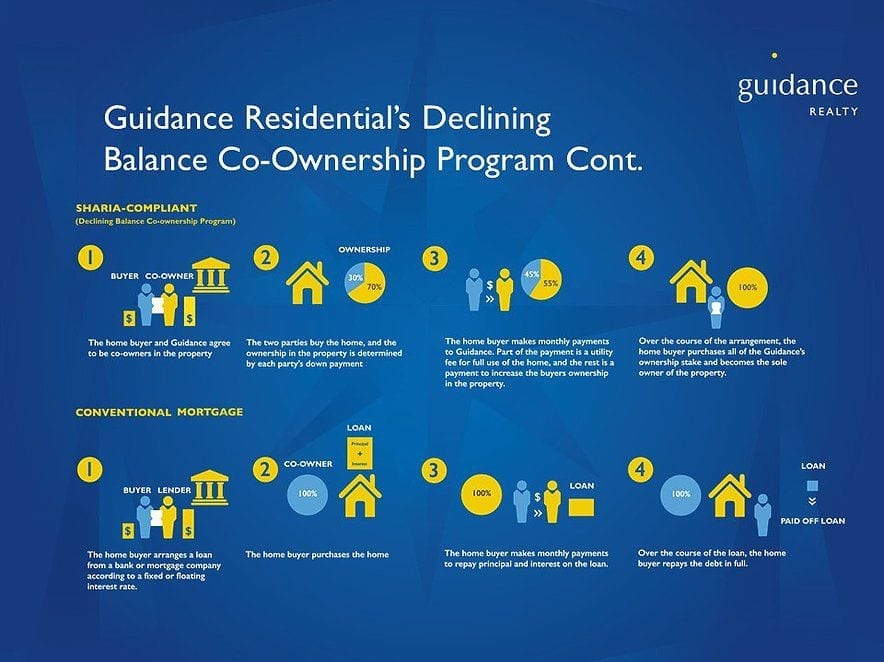

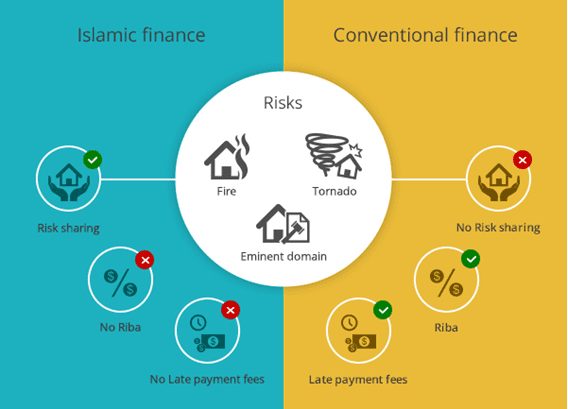

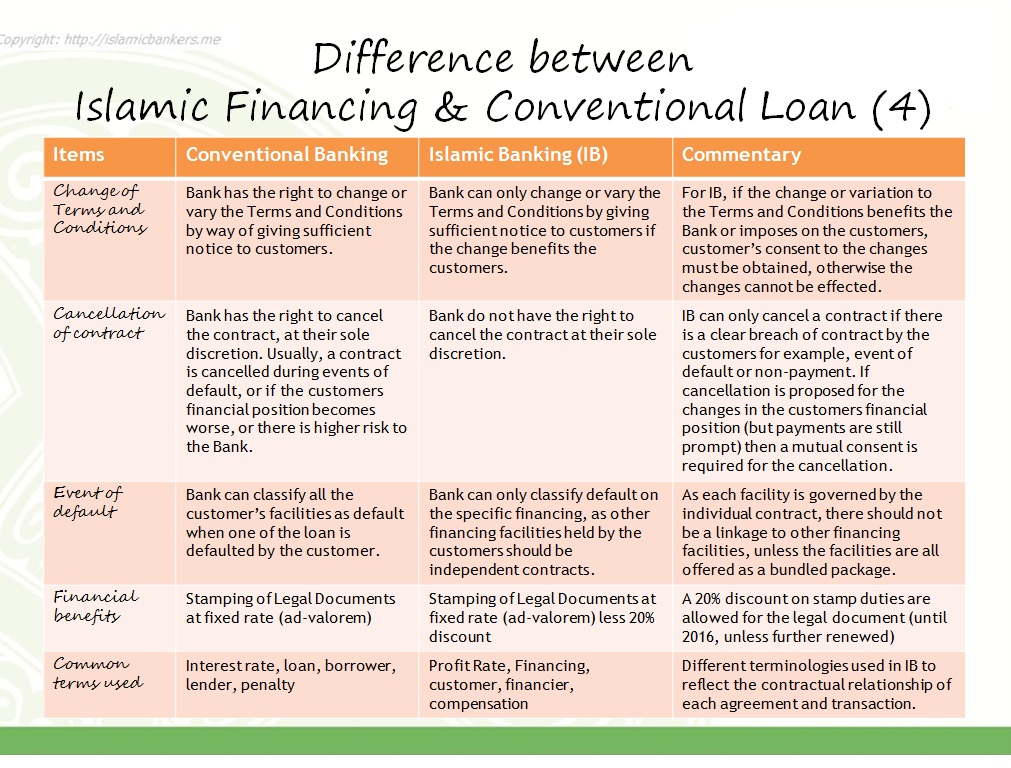

In a conventional mortgage the bank immediately applies late penalties to each payment that is missedtypically about 5 of the payment owed. For Conventional loans if a borrower alters the terms of the finance Eg. What is the difference between Islamic home finance and conventional home loan.

Same stuff different term. There is a myth Islamic home loans are cheaper than conventional home loans. Ad Helping the people of Ijara community development with Islamic Loans.

Interest rate is calculated based on the money. Related PostsIslamic Finance Development in the WorldNews Digest in Islamic Finance May. Benefits of Conventional Financing over Islamic Financing 1.

In this article we examine what these differences can teach us about risk and. In a conventional loan the customer will repay to the bank the loan amount together with interest at the prescribed rate. Quick and Easy Application.

But just be aware that Islamic stamp duty is cheaper by 20. Islamic financing is an alternative to conventional financing that complies with the principles of Islamic law. Profit rate is calculated based on fixed rate financing without any additional costs cannot be compounded.

Profit Rate vs Interest. A conventional mortgage is where your loan repayments will include paying a rate of interest to the bank this is their profit for lending you the funds. Prices were relatively high in the early years of Islamic home financing in North America.

Unlike conventional loans where. The main difference between Islamic and conventional finance is the treatment of risk and how risk is shared. The loan cost is almost the same or sometimes higher than.

Increase the facility amount the Loan Facility. Ad 10 Best Mortgage Rates of 2022. Due the extra loan documents for Islamicit turns out to be same fees.

Apply Easily Get Pre Approved In Minutes. What is an Islamic loan. Get Instantly Matched With Your Ideal Home Financing Lender.

Get All The Info You Need To Choose a Mortgage Loan. On a 2500 mortgage payment that equals. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ad With AutoPay and for specific loan purposes. Islamic finance often uses profit-sharing models because Islamic law.

Ad We Offer Loans For Your Business Needs.

Differences Between Conventional Banks And Islamic Banks Download Scientific Diagram

Islamic Finance Is Not More Expensive Than Conventional Home Loans

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

0 Response to "Islamic Loan Vs Conventional Loan"

Post a Comment